MAY 2023

ASB LOOKS AT

Why the Real Estate Industrial Sector Maintains Strength

Context The Federal Reserve’s inflation fighting policy of raising interest rates has pushed real estate yield requirements higher and caused value losses across all sectors. But industrial distribution and logistics assets have experienced the least negative impact after registering extraordinary gains in the 2020 to mid-2022 period.

Fundamentals Despite the cooling economy, industrial supply-demand fundamentals remain very strong across most U.S. markets. Tenant demand has remained largely unabated giving landlords’ pricing power, supporting long-term NOI growth. In turn, assets experiencing organic growth in cash flows can maintain value better in an environment where yield requirements are moving higher. Tenant demand is not only based on meeting growing e-commerce distribution, but also “just-in-case” warehousing to protect against supply chain dislocation.

Pricing Dynamics A combination of longer lease terms and rent growth which has registered significantly above inflation in recent years, has left many warehouse rent rolls below market and offers continuing upside as in-place leases expire. Under this scenario, an asset’s stabilized cap rate is often seen as more important than its going-in cap rate.

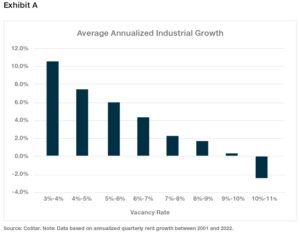

New Supply Even if the 670 million square feet of industrial space under construction (as of year-end 2022) were delivered immediately, industrial vacancy would increase from 3% to only about 5.6%. That’s just slightly above the 10-year average.1 Over the past 20 years, when industrial vacancy has registered between 5% and 6%,rent growth has averaged a healthy 6%.2 (see Exhibit A) In addition, strong pre-leasing activity representing 24 percent of the current development pipeline speaks to favorable underlying fundamentals.3

New Supply Even if the 670 million square feet of industrial space under construction (as of year-end 2022) were delivered immediately, industrial vacancy would increase from 3% to only about 5.6%. That’s just slightly above the 10-year average.1 Over the past 20 years, when industrial vacancy has registered between 5% and 6%,rent growth has averaged a healthy 6%.2 (see Exhibit A) In addition, strong pre-leasing activity representing 24 percent of the current development pipeline speaks to favorable underlying fundamentals.3

E-Commerce Growth In the wake of expanding e-commerce, modern industrial logistics facilities form the backbone of the distribution footprint that facilitates delivery of goods directly to homes and businesses. Even with the ongoing economic uncertainty, e-commerce continues to garner a growing share of retail sales relative to brick-and-mortar as retail sales have surged well past pre-pandemic levels. The trend lines are clear. Although inflation and possible recession pose potential short-term risks, e-commerce growth will continue to help solidify industrial fundamentals over the longer-term.

Warehouse Utilization Industrial demand also has been bolstered by changes in how retailers and industrial users manage their warehouse operations. Supply chain disruptions experienced during the pandemic have resulted in industrial users growing inventories and creating supply route alternatives to promote resiliency and redundancy. This change in approach from “just-in-time” to “just-in-case” inventory practices bolsters industrial demand. In addition, the repatriation of more manufacturing and production as companies mitigate supply chain risk, also supports domestic demand for industrial space.

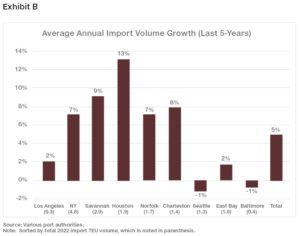

Winners and Losers Certain markets appear better positioned to advance from the post-pandemic tailwinds driving logistics demand. Greater freedom for hybrid and remote work has accelerated net migration to more affordable, lower-tax, business-friendly geographies in the Southeast and Southwest, benefiting those industrial markets. The onshoring wave also helps Phoenix’s new U.S.-Mexico customs clearance facility. The reworking of supply routes shifts more traffic to East Coast and Gulf ports—Savannah, Norfolk, New York-New Jersey, and Houston—and away from the notoriously congested West Coast. (see Exhibit B)

1, 2, 3 CBRE Capital Markets Weekly Update (Feb. 2023)

Download to view full report and graphics